The government’s tertiary student support package for Covid-19 dropped yesterday. To get support, students need to take on $1000 of debt that cannot be used to pay rent or buy food. The government has also made changes so that Studylink will not penalise students for dropping courses by cutting off their living costs, or by changing their eligibility for fees-free or future student loans (which would have been a dick move anyway).

That’s the entirety of the tertiary student support package. Even that limited support is unavailable to part-time students and international students. We waited three weeks for this.

None of the other Covid-19 financial packages require people to take on personal debt to continue through the crisis. A $1000 loan for students in the middle of a pandemic, facing an economic crisis, is laughable. The tertiary student support package is an unsurprising, unfunny joke.

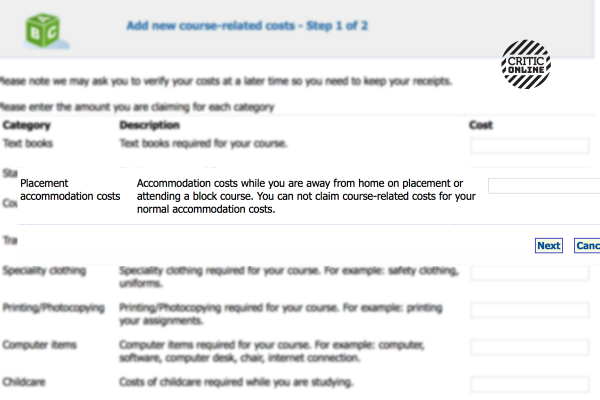

The punchline of the joke is that if students use course-related costs for rent or food, they’re technically committing fraud. Course-related costs are designed to be spent on textbooks and laptops and field trips. Raising the amount of course-related costs to $2000 for the year does not, from the government’s point of view, help students with rent or food.

Education Minister Chris Hipkins’ press secretary confirmed this to Critic. When asked if students could use the course-related costs increase of $1000 for rent, he said that they could use it for power and internet, but not food. He didn’t specifically say no to rent, but he did very obviously avoid that part of the question, which we will take as a “no.”

The joke is that, whatever the government says, students use course-related costs for whatever they want. A trip to Japan. Alcohol. Drugs. It’s $1000 of cash and I don’t know anyone who’s been audited by Studylink for spending it.

The support package might be a nod to the poorly-kept secret about course-related costs spending. Or the government might be targeting those students who cannot learn online due to broken laptops or weak internet connections.

But leaving living costs untouched fails to address the main problem. Either the government hasn’t considered what students are struggling with or they’re completely unwilling to reach beyond the current student loan system to help students.

In his press release on the package Minister Chris Hipkins claimed that “[t]hese pragmatic measures, coupled with the support MSD can already give, will provide an immediate response to the financial impact Covid-19 is having on tertiary students.”

The MSD support appears to be emergency grants, because students are not eligible for other support from MSD due to Studylink payments. Hipkins refers to the emergency grants as if they are an alternative to Studylink for students. But the MSD grant is only available if students have no other way to pay for food or other emergency services like medical treatment. It cannot be used for normal accommodation costs.

Minister Hipkins hints that “a second package of changes” is in the works, but makes it pretty clear that these will be “to prepare the system for significant growth in key strategic areas”. That doesn’t sound a whole lot like “we will give money, without strings attached, to students soon”.

And that’s disappointing. When I saw hints that the government was working on a support package for students, I was hopeful.

Employers, employees, and landlords have all received generous and immediate financial support from the government. Benefits, including jobseeker support, increased by $25 per week from 1 April.

Covid-19 has been rough and has placed students in tough financial situations too, particularly in terms of paying rent for flatmates who have left or coping with increased power bills.

But a $1000 loan is a distraction. It will be welcomed and taken up, because for a lot of students, their debt is an imaginary monster that won’t hurt them until they have left university. That doesn’t make it adequate.

Increasing course-related costs, which is a one-off payment, is the least disruptive way to give students cash within the current framework. It does not change the problem, which is that students have to go further into debt in order to get financial help in a crisis.

Debt is not support. We face an employment market with grad jobs drying up by the second, losing part-time work for the foreseeable future, and immediate costs like hefty power bills due to the lockdown. Unless the government can provide a debt-free alternative to assist students with their living costs, they are just adding one extra way students will suffer because of Covid-19.